By Stephen Lepitak

InterPublic Group’s chief executive Michael Roth took time to catch up with The Drum and discuss a few of the industry trends taking place during this year’s Cannes Lions festival. In a relaxed and jovial mood, he was open to discussing his views on the value of the festival itself, his thoughts on some of his rivals, the growing emergence of the consultancies into the creative sector, pricing issues and Amazon as an advertising platform.

How are you enjoying Cannes this year?

We have had a great showing in terms of the Grand Prix [category] and its across our healthcare as well as our creative – so it’s a combination which is terrific. Our agencies are going well. They are psyched about their performance which they should be. I’m meeting great clients here and that is what this is all about — sitting down with clients, potential clients, our partners and our people for meetings. I’m meeting people from all over the world [and] they don’t hesitate to come up to me and talk — and it’s always nice to once in a while to spend time with our competitors and see what they are up to. There were no fist fights during the meeting which was good. We try to be civil about it. There’s no reason not to be. In fact, there’s been a change in one of them – Maurice [Lévy] and [Sir] Martin [Sorrell] never got on anyway and I was curious if Martin and Arthur would have the same issues. It’s soon to tell but I would imagine they will.

What do you make of Arthur Sadoun?

The first time I met him was this morning. He seemed pleasant enough. He’s making some bold decisions and we’ll see where that takes him. Maurice is an icon in our industry. He’s not really gone and I always enjoy spending time with Maurice.

And what do you think of all the talk of Cannes and networks pulling out?

We cut back a bit in our attendance. We have to look at Cannes as we look at any other investment and what the return is on investment — and that’s just a question of how much we participate from a cost point of view.

We believe in creativity and this is a great platform for that and I wish we were only focusing on creativity because that’s what this is about. The fact that we have all these other things going on, on one hand it’s good because it gives us more exposure to the rest of the world, but it’s kind of hectic and costly, frankly.

As we did this past year we’ll take a look at who came and how much it cost, what the feedback it is and the benefit. I don’t see us pulling out of it. Our creative people do amazing work and to be recognized for it, candidly I don’t know many clients that say we want an agency that never won a Cannes Lions. So it helps.

But people continually complain that the creative side has been lost somewhat.

I don’t think it’s lost, it changes in terms of how it’s applied and when you use it. The technology is a benefit to our industry. We just have to make sure that we are part of it and that we are ahead of the curve in how that technology is applied, but without the creative big idea it’s hard to communicate with your consumer without that and that involves creativity.

The consultancies are here in force and they want to become a part of that creative sector. How do you feel about that?

I understand why they are doing it because they are already [with] the clients doing system integration — so they feel like they may as well leverage their relationship with the client.

We have a unique position within the industry to recruit and retain special people on the creative side who like to work with great brands, who like to be famous and make clients famous. It’s hard to believe that anyone other than the creative industry can handle that opportunity. And now they are buying creative agencies but the firepower that a McCann or an FCB or a MullenLowe can provide in terms of creativity is unbelievable. Just look at our Grand Prix’s.

I’m not worried about it. The only part of it that worries me is when, sometimes, in order to obtain work [consultancies] throw it in as an afterthought and that is an issue in terms of getting paid for value. They are here and they are going to be here. We haven’t run into them a lot when pitching — but when we do, it’s mostly on the digital side of the business and, frankly, we fair pretty well on that front.

So they are not an issue you are preparing for yet?

Actually, the opportunity is to partner with those firms. If they have an expertise that we don’t have and we have an expertise that they don’t have and we are working on the same clients then why don’t we partner?

Have you done that though?

Well, I’ve said it before but my phone isn’t ringing off the hook. (He laughs.) It is an opportunity to partner.

Bob Greenburg at R/GA is always reinventing the business to keep it fresh. How do you work with him in determining that?

I support it and invest in it. The business transformation that R/GA and Huge are doing is in reaction to the consultancy issue, no question about it. When we review Bob’s business plans I support it 100% and it’s a logical extension of their capabilities and the talent that they have and how they bring it to execution and it’s a big growth part of their business. I like that.

Have you considered adopting that ethos of continuous reinvention within any other of the agencies?

We have Huge which, when we bought it, had 80 to 100 people — and now they have 1,100 people all over the world and they are doing business transformation and consultancy so we see it there. We see it in our PR businesses and some others do consultancy in terms of brand transformation. It’s a logical extension of our capabilities. So the way the consultancies look at it, we look at it similarly.

What’s exciting you in the business personally right now?

All this change is exciting. It’s kind of scary as you want to make sure you win and you have the resources to win, but change is good for our business because clients need someone to help them navigate through it — and if we have the resources, which we do, we have the tools and the talent and scale to help our clients whether it be on the media side, the digital side, the experiential side, the PR side and obviously the creative side – that’s what we do.

All this confusion is good for our business because clients and partners we work closely with to do this. Just walking down the road here you see new people who weren’t here five years ago and now they have a big presence.

So Cannes is a good representation of the industry?

Yes but, again, there is a point where the expense is something we have to watch.

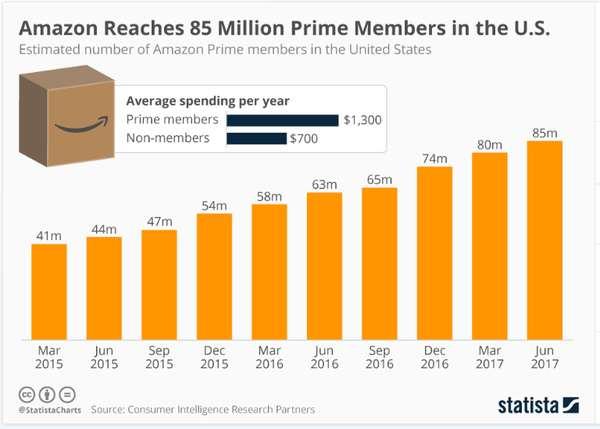

What’s your take on Amazon’s growth as an ad platform?

They see opportunities, they have the platform, they have the capability and they do it. It’s a fascinating story of how companies can leverage their core capabilities in other areas and its great for the consumer as long as it’s operated in a way that consumers expect it to be — and if it becomes something other than that, there will be pause for concern.

It raises really interesting issues about the future of ecommerce and the future of some traditional businesses that one never really thought of as being part of ecommerce; Walmart and all these businesses have a food and ecommerce platform, for example.

As an advertising platform, how do you see it?

It’s an opportunity. Our business is to reach consumers on behalf of our brands and if Amazon has that capability ± so you can tie in reaching the consumers with the commercial part of that in the same place – what’s wrong with that?

Have you visited their new bookstore yet?

I haven’t, but it’s interesting to see them go back to that…what goes around comes around. There’s still a place for brick and mortar and people still like to go into a store and see the product and walk around and experience it. Like everything else, it’s reach and where the consumers are. If the consumers are there then we’re going to use it. That’s true of TV, the true of print and now it’s true with ecommerce versus brick and mortar.

What are your views when it comes to the agency competitive pricing issue?

We have to prove value and it goes both ways. If we can add value then our clients should pay us for it.

We are entitled to put a margin on our business and the worst thing that can happen to our industry is to become commoditized because we are not a commodity industry.

Creativity and value; what’s it worth to come up with a great campaign that puts a brand on a marker. What bothers me about our business is the potential for it to become commoditized which is why it is incumbent upon us to really focus on the value proposition.

Do you see any solution to agencies undercutting one another though?

The solution to it is whether you can continue to deliver the quality of the work and the quality of the people when you are not getting paid for it. You get what you pay for and if a company competes for business by pricing it irrationally, then eventually it is shown in the work. Hopefully, that will take care of it. Like every other business, people are worried about margin and revenue and little things like that (he laughs again).

Michael Roth was speaking after seeing Interpublic Group win several major prizes including MRM//McCann Madrid picking up its first with its’online science fiction film called ‘Beyond Money,’ created for Santander.

Image: IPG chief executive Michael Roth