Sourced from Seeking Alpha.

- Software-as-a-service stocks are considered extended by many analysts.

- Financial media regularly cover the idea of a SaaS bubble, creating wide ranges of expectations and significant movements post earnings.

- In this context, investing in high-flying SaaS stocks can be daunting and requires a leap of faith.

- Looking for the right favorable features can help you find the winners in this category and invest confidently, even when they are highly volatile.

- I break down five essential traits that you should always look for before you invest in a SaaS business.

- I do much more than just articles at App Economy Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Since Marc Andreessen published his essay Why Software Is Eating The World in 2011, software companies have been some of the very best-performing public equities. Companies like Salesforce (CRM), Atlassian (TEAM) or ServiceNow (NOW) are fantastic success stories of the past decade.

In recent years, Software-as-a-Service (or SaaS for the rest of this article) has really taken the spotlight. And for good reasons. IT purchasing has become decentralized, sales cycles are now shorter and product adoption is more nimble than ever.

Most SaaS companies offer the best aspects of a digital business:

- Virality with freemium models targeting developers and teams.

- Scalability with large TAM (total addressable market).

- Optionality with rapid innovation in machine learning and AI.

- Profitability with gross margins often north of 70%.

- Predictability with an increasing level of recurring revenue.

- Accelerated tailwinds created by the COVID-19 global pandemic.

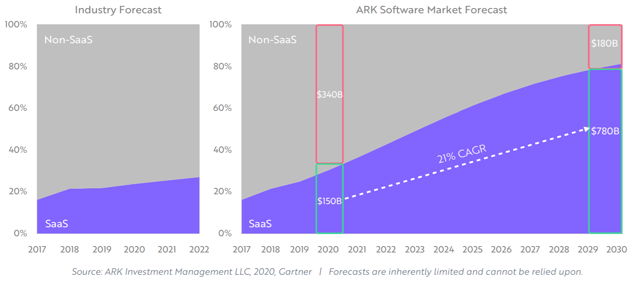

Recently, research firm ARK Invest provided an update on their software market forecast, showing an expected 21% compound annual growth rate for SaaS businesses in the coming decade. They explain:

Despite incumbents and startups embracing Software-as-a-Service, the SaaS market still makes up just 25% of the enterprise software market. According to industry forecasts, annual SaaS revenue growth will decelerate from 16.1% in 2019 to 13.6% by 2022, reflecting, in our view, “reversion to the mean” thinking. Instead, as shown above, we believe that at 25% share, SaaS probably hit an inflection point during the coronavirus crisis and, according to classic S-shaped adoption, is likely to capture an increasing share of the enterprise software market. If our forecast is correct, SaaS revenues will grow at a 21% compound annual rate for the next decade, topping $780 billion or 80% of the enterprise software market by 2030.

The notion that SaaS is likely to become the dominating category in software really resonates with me. With lower barriers to entry and a product adoption moving from top-down (management-driven) to bottom-up (team-driven), the ongoing disruption is likely to continue its path forward.

Now, a category entering the “scale” part of the S-curve can create tremendous investment opportunities. But they come with their fair share of risks. In a nascent industry, the ongoing disruption can turn today’s winners into tomorrow’s losers for reasons that can be virtually impossible to predict.

For many investors, the idea of investing in companies that are not generating a net profit or positive cash flow is unbearable. And that’s okay. If you are not fully on board with the bullish thesis behind an investment, chances are that you will bail as soon as the stock loses its momentum.

Given the potential growth ahead and the inherent risks of continued disruption from existing players and newcomers, investing in SaaS requires a mindset that can only work for some investors. You need:

- A strong stomach, since most SaaS stocks are extremely volatile.

- A leap of faith, since many of these businesses are still losing money.

- A long time horizon, since gains will compound for the best performers.

- A diversified approach, since the winners are likely to more than offset the losers over the long term, but there is no guarantee to own the biggest winners without having a basket approach with several prospects.

After the recent runs of the S&P 500 (SPY) and the Nasdaq (QQQ) to new highs in the midst of a recession, it has become increasingly important to know what you are doing before making your next investment decision. Companies like Alteryx (AYX), Fastly (FSLY), Datadog (DDOG) or BlackLine (BL) had pullbacks of more than 20% after their most recent earnings report.

With all this in mind, I wanted to cover today the essential traits you should be looking for before buying a SaaS stock. They are important quantitative and qualitative traits that should enable you to stack the deck and put the odds in your favor for the long term.

Let’s review.

1) Strong track record of revenue growth

Returns over time can come from two main sources:

- Earnings growth.

- Multiple expansion.

The latter seems to generally coincide with the former. Accelerating earnings growth will usually receive a higher valuation from Wall Street. The ebb and flow of valuation multiples is usually driven by the strength of the underlying business.

For earnings to grow, a company can do two things:

- Grow its revenue

- Improve its profitability

Since margins can only improve up to a certain point, the big winners that can generate outstanding alpha will tend to have a capacity to grow their revenue at a consistent and elevated pace for years. When you invest for the long term, consistency matters just as much as the velocity of the growth.

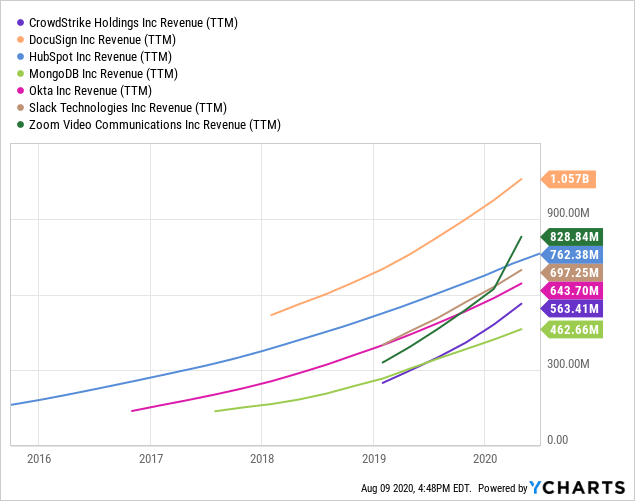

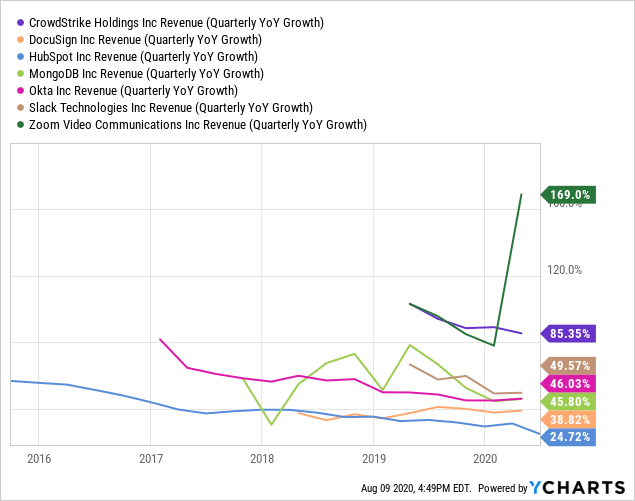

Let’s look at the revenue trend of a group of relatively young SaaS companies that are disrupting a wide range of industries such as communication, productivity, inbound marketing, database management or cybersecurity.

This is what the top line of a company you want to invest in should look like. Up and to the right.

Data by YCharts

Data by YCharts

In the chart: CrowdStrike (CRWD), DocuSign (DOCU), HubSpot (HUBS), MongoDB (MDB), Okta (OKTA), Slack Technologies (WORK), Zoom Video Communications (ZM)

That’s the revenue trend you should really be looking for when you invest with a multi-year time horizon. And over an extended time, the stock price chart is likely to follow the fundamentals as they improve.

Data by YCharts

Data by YCharts

As these businesses grow over time, the pace of the revenue growth is naturally fading due to the sheer size of the revenue base. A slowing revenue growth is inevitable. It should be expected and put in context:

- Is revenue growth fairly consistent to a point where it can be extrapolated?

- Has growth re-accelerated in the past?

- Does the current trend appear sustainable?

- Is the recent slowdown a temporary hiccup or the beginning of the end?

These are questions you want to answer before moving forward.

2) Margin expansion

In an effort to screen SaaS businesses and separate the wheat from the chaff, most investors are familiar with the rule of 40, the principle that a software company’s combined growth rate and profit margin should exceed 40%.

As explained by Thierry Depeyrot and Simon Heap, partners at Bain & Company:

“The Rule of 40 […] has gained momentum as a high-level gauge of performance for software businesses in recent years, especially in the realms of venture capital and growth equity. Increasingly, software industry executives are embracing the Rule of 40 as an important metric to help measure the trade-offs of balancing growth and profitability.”

Now, it can be very misguiding to write off entirely a company simply because it fails the rule of 40. Many companies with an operating margin in deep negative territory can show tremendous improvement in a matter of a few quarters. And the stock of such a company will tend to rally long before the fundamentals put the business favorably on the rule of 40 map.

The SaaS companies that are able to grow very fast tend to re-invest in themselves aggressively. This re-investment can take many forms, such as a hiring surge in new research & development headcounts or some aggressive spending in marketing to acquire new customers.

When strong revenue growth is involved, you are likely looking at a company that is still in its hyper-growth phase. As explained previously in my article about 10 Semi-Controversial Traits Of Some Of The Best Stocks, it’s somewhat useless to try to evaluate a company that is still in its hyper-growth phase based on backward-looking profitability ratios.

Instead, what can be insightful is to look at how the profitability ratios are evolving over time and how the company has been able to show economies of scale and improve its margins as revenue grows.

For a company in its growth phase, margin expansion matters immensely more than where the margin is in the most recent quarter. To illustrate, let’s look at a few examples.

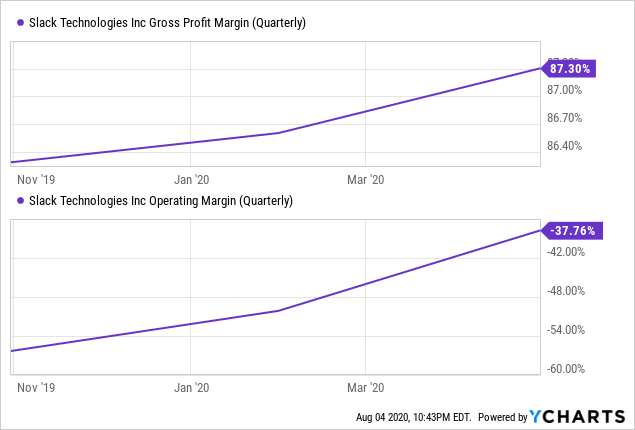

Data by YCharts

Data by YCharts

First is Slack Technologies, a software platform focused on productivity and communication. Slack has always looked bad when evaluated on the rule of 40 due to its massive operating losses. But things may not stay this way for very long:

- Gross margin has steadily improved reaching an outstanding 87%.

- Operating margin recently shot up from -56% to -38%, an improvement of 18 points in a matter of two quarters.

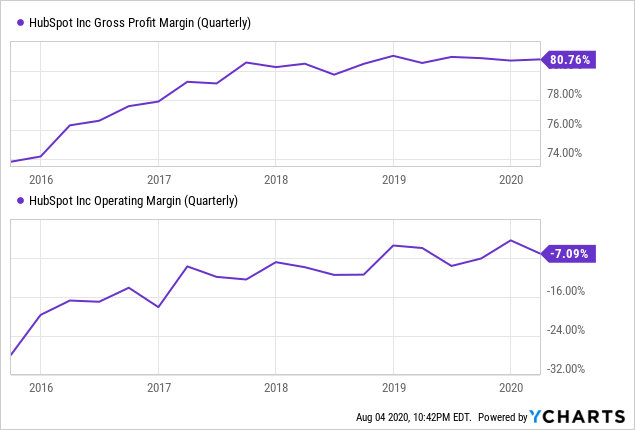

Data by YCharts

Data by YCharts

Second is HubSpot, a cloud-based marketing, sales, and customer service software platform that focuses on inbound marketing. The company has a track record of expanding its margins at a steady pace:

- Gross margin improved by 7 points in the past five years, reaching a very impressive 81%.

- Operating margin went from -28% to -7%, an improvement of 21 points since 2016.

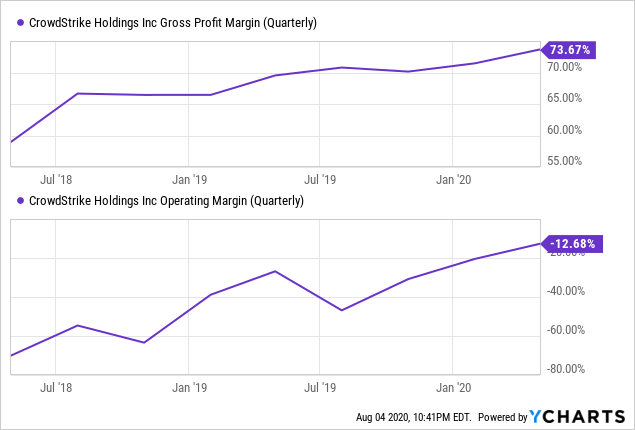

Data by YCharts

Data by YCharts

Finally, CrowdStrike (CRWD) is bursting through any expectations set by Wall Street quarter after quarter, showing economies of scale to die for:

- Gross margin improved by 15 points in the past two years, reaching 74%.

- Operating margin went from -70% to -12%, a staggering improvement of 58 points in a matter of a few quarters.

All in all, you have to look beyond what the income statement looks like today and focus on what it may look like at the end of a multi-year time horizon. When you look at the margin trend of companies like Slack, HubSpot or CrowdStrike, there is no doubt that their margin profile will significantly improve in the coming years.

3) High dollar-based net retention

Over time, some customers pay for more services, some decide to scale back their usage, and some decide to leave altogether. The dollar-based net retention rate (or net revenue retention rate) is the ultimate performance indicator that tells you how much money a company is still making from a cohort of customers after a full year.

Sammy Abdullah, co-founder of Blossom Street Ventures, explains:

Net dollar retention tells you what percent of revenue from current customers you retained from the prior year, after accounting for upgrades, downgrades, and churn.

If the dollar retention rate is above 100%, you are looking at a company that would be growing its top line even without adding new customers.

Some companies use their own definition of this metric or name it differently. It’s essential to read the fine print and understand the KPI you are looking at. For example, a company like Twilio (TWLO) shares its dollar-based net expansion rate as part of its earnings reports. At the end of the day, you want to make sure a company is including the impact of churn in its calculation.

Churn measures the rate at which you are losing customers. Most of the time, it is measured as the percentage of customers who discontinued their subscription in the past year. The churn rate is immensely important in an industry that relies on a subscription model. That’s why you should always focus on metrics that include the impact of churn to evaluate a SaaS business.

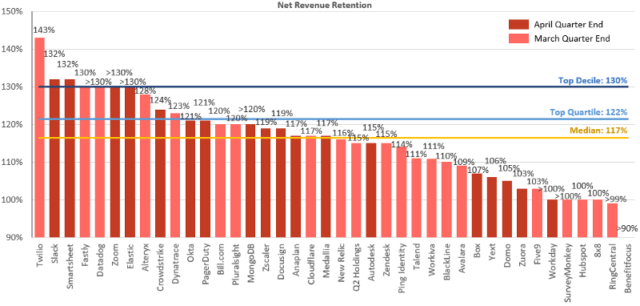

Jamin Ball, VP at Redpoint Ventures, does a fantastic job at synthesizing SaaS company earnings and comparing their KPIs. After the first earnings season of the year, he posted a summary chart of the net revenue retention.

A high (and ideally improving) net revenue retention rate should be the most critical KPI to look for before investing in a SaaS business. It’s a tangible way to assess the health of a service, its sustainability and relevance for customers.

Since this KPI is so important, you’ll find a strong correlation between the dollar-based net retention and the valuation multiple of a company. In other words, be careful before investing in SaaS companies that have a cheaper valuation. As most things in life, you often get what you pay for.

4) Sales Efficiency

You can create tremendous revenue growth if you sell one-dollar bills for 90 cents. But that won’t necessarily be the foundation of a sustainable business. That’s why you want to dig deeper into the unit economics.

If you are looking at a company that is 1) growing its revenue fast, 2) expanding its margins, and 3) growing its existing accounts over time, things are already looking pretty good.

But one more KPI needs to be evaluated. One that focuses on a company’s potential to sustain its revenue growth and margin expansion over time. And that factor is sales efficiency.

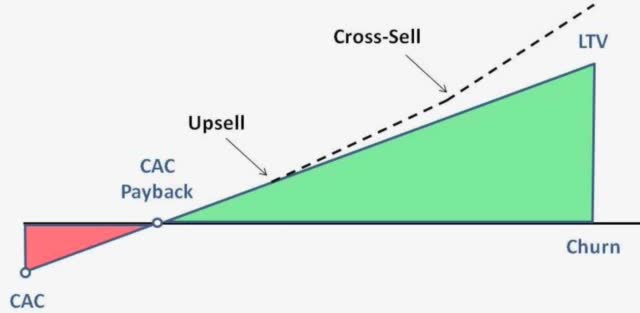

Is the company able to acquire customers in a way that is accretive to its bottom line fast? That’s what the CAC Payback Period can help you find out.

The CAC Payback Period is a concept I came across in the gaming industry, working on free-to-play games. Video game publishers spend money on ads to generate downloads. As long as the LTV (Customer Lifetime Value) is over the CAC (customer acquisition costs) over time, this is money well spent. The CAC Payback Period (expressed in months) illustrates how many months it would take to recoup your investment in sales & marketing based on your current revenue run-rate.

The velocity at which the CAC is recouped can confirm that you have a strong product – market fit with a growth that is sustainable.

You can find different ways to calculate the CAC Payback Period of public SaaS companies. For the most part, you need to know two things:

- Sales & Marketing costs from previous quarter (which is the CAC)

- Net new ARR (Annual Recurring Revenue) in the most recent quarter.

While sales & marketing costs come straight from the income statement, it can be a little bit trickier to estimate net new ARR added in the most recent quarter. Some SaaS companies report directly their ARR as part of their earnings report. For some others, you might have to calculate it yourself by using the subscription revenue added sequentially in the most recent quarter, and multiply it by four to get an annual number.

In order to factor the cost to maintain the service into the equation, you can then apply the gross margin to the Net New ARR to obtain the new recurring gross profit expected to be generated in the next 12 months:

[(Sales & Marketing costs from previous Q) / (Net new ARR x Gross Margin)]

This will tell you how many years it would take for the sales & marketing costs from the previous quarter to be recouped with newly created gross profit looking forward. Multiply this formula by twelve, and you’ll get the CAC Payback Period in months.

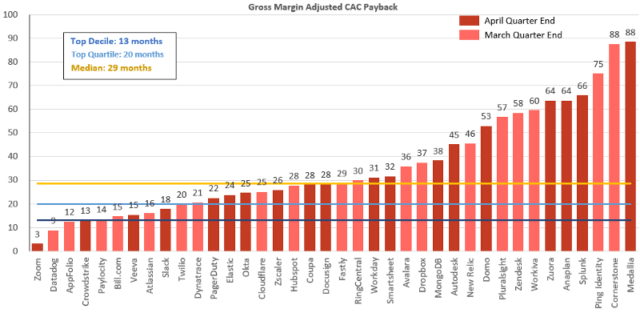

Using CrowdStrike’s most recent earnings reports as an example:

[75.8 / 66] x 12 = 13.7 months.

This means that it takes slightly more than a year for CrowdStrike to recoup its sales & marketing costs via new gross profit generated. This is particularly good, since most public SaaS businesses have a CAC Payback period of more than two years, as illustrated below with Q1 CY20 data when applicable.

5) Inspiring leaders with a lot at stake

Beyond these quantitative KPIs, one of the best ways to put an investment to the test is to evaluate the people in charge. To do so, you want to answer three questions about the leadership team:

- Are they part of the founding team?

- Are they still heavily invested in the company?

- Are they a source of inspiration to their employees?

In an ideal world, if you are looking at a best-of-breed SaaS business, you should be able to answer “yes” confidently to these three questions.

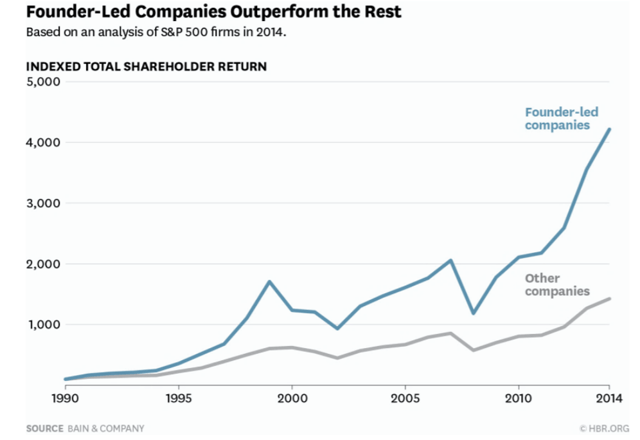

According to Bain & Company, companies where the founder is still involved performed 3.1 times better than other companies over a 25-year period (1990 to 2014). As explained by Advisory Partner Chris Zook:

We found that the companies most successful at maintaining profitable growth over the long term were disproportionately companies where the founder was still running the business.

It all makes sense. Founders are guided by an extreme sense of purpose, with the business representing the fruit of their labor. They are more likely to be fully engaged with their role and the impact of their business on the world at large. They will want to lead by example, be pragmatic and focus on getting the work done. Founders are willing to take risks to take their company to the next level.

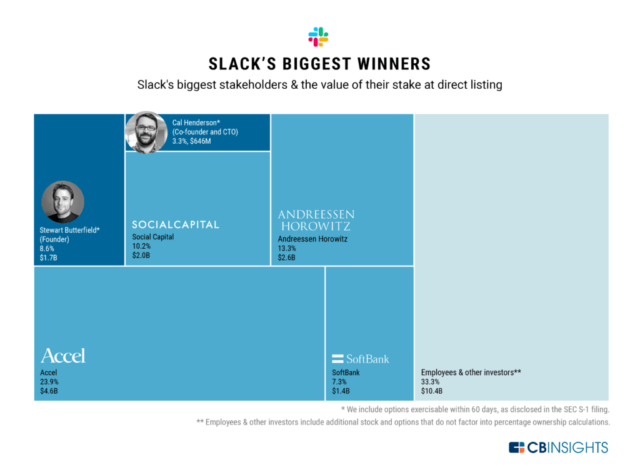

You’ll also find an owner’s mindset within a leadership team that has a lot at stake. It usually takes the form of a high insider ownership. Slack is again a perfect example, with founder-CEO Stewart Butterfield still owning 8.6% of the company at the time of the direct listing.

Finally, an obvious and easy way to evaluate the culture at the top is to look at the Glassdoor reviews. Glassdoor is a platform where employees can review their companies and CEOs. Lackluster reviews can lead to profound challenges to hire and retain talent, particularly in competitive markets such as the San Francisco Bay Area.

The platform enables outsiders to evaluate if a company is recommended by its own employees and celebrated for its culture.

History shows that the way employees praise their company might be a much more compelling investment factor than P/E ratios, free cash flow margins, or any other financial metrics. This is a conclusion I’ve reached after reviewing the performance of companies appearing on the Best Places To Work on an annual basis based on Glassdoor’s rankings.

A word on valuations

If you are willing to expand your time horizon to years or decades (as opposed to days or months), what you buy matters much more than the price you bought it for.

The best SaaS companies eventually “grow into” their valuations. The ones that fail to deliver on their original premise will tend to under-perform the market, no matter how cheap you were able to pay for them.

Some conclusions should come to mind:

- Focusing solely on valuations is a mistake that will likely keep you away from the best performers of this group, the very companies you should be invested in based on their fundamentals.

- Given the extreme volatility of high-growth SaaS companies, the question shouldn’t be if you should buy stock XYZ, but how you should buy it.

- Significant draw-downs of 20% or more happen several times a year for most public SaaS companies, regardless of the market volatility. As a result, major pullbacks will generally be opportunities to accumulate shares.

- Position sizing matters immensely when investing in high-flying SaaS businesses. The winners will tend to more than offset the losers, but only if you adopted a balanced and diversified approach by giving several positions the opportunity to bloom.

- Always assume that you could be wrong. If you put more than 20% of your portfolio in a single company that is yet to be profitable and makes less than a billion in revenue per year, you only have yourself to blame if you end up losing money or trailing the market.

If you are looking for a portfolio of actionable ideas like this one, please consider joining the App Economy Portoflio. Start your free trial today!

The rise of the App Economy is disrupting many industries: retail, entertainment, financials, media, social platforms, healthcare, enterprise software and more.

Sourced from Seeking Alpha.