By Meg Prater

In many ways, marketing is a game of trend watching. The marketer who’s best at spotting and using trends earns their business market share, brand recognition, and ultimately, revenue.

But how do you search for trends? And where do you start? Well, since they own about 92% of the global search engine market, the answer to both of these questions is, “Google.”

Click here to get everything you need to get your website ranking in search.

How many people use Google?

Google has 92.42% of the search engine market share worldwide. That breaks down to approximately 72% of the desktop market and 92% of the mobile search engine market share. The United States leads with the most users. 27% of Americans use Google.

So, let’s look at a few of 2019’s top Google Search statistics and take a deeper dive into the trending searches that guide your marketing strategy.

Top Google Search Statistics in 2019

Now that we know how to search for trending topics, let’s look at how Google influences search with these latest statistics.

How many Google searches per day?

Google does not share their search volume data. However, it is estimated Google processes approximately 70,000 search queries every second, translating to 5.8 billion searches per day and approximately 2 trillion global searches per year. The average person conducts between three and four searches each day.

1. The top five Google searches in 2018 were “World Cup,” “Hurricane Florence,” “Mac Miller,” “Kate Spade,” and “Anthony Bourdain.” (source: Google)

2. 8% of search queries are phrased as questions. (source: Moz)

3. The typical user crafts searches that are about three words long. (source: Moz)

4. As of February 2018, 62.6% of web users conduct their searches on Google — up from 53% in 2015. (source: SparkToro)

5. 79% of keywords and 47% of keywords in positions 1-20 rank differently on mobile and desktop. (source: BrightEdge)

6. In 2018, Google Images accounted for 22.6% of all internet searches and Google Maps accounted for 13%. (source: SparkToro)

7. Compressing images and text could help 25% of web pages save more than 250KB and 10% save more than 1 MB. These changes reduce bounce rates and increase page rank on Google SERPs. (source: Google)

8. In 2018, Google properties owned over 90% of all searches. (source: SparkToro)

9. In 2017, 50.3% of web traffic took place on mobile phones. (source: Statista)

10. Branded searches have higher click-through rates on the first half of the first page of Google. (source: Internet Marketing Ninjas)

11. The average click-through rate for first position on a Google search query is 19.30% and the click-through rate for second position is almost half at 10.57%. (source: Internet Marketing Ninjas)

12. The average click-through rate for first place on desktop is higher than that of mobile, at 31.52% and 24.05% respectively. (source: Advanced Web Ranking)

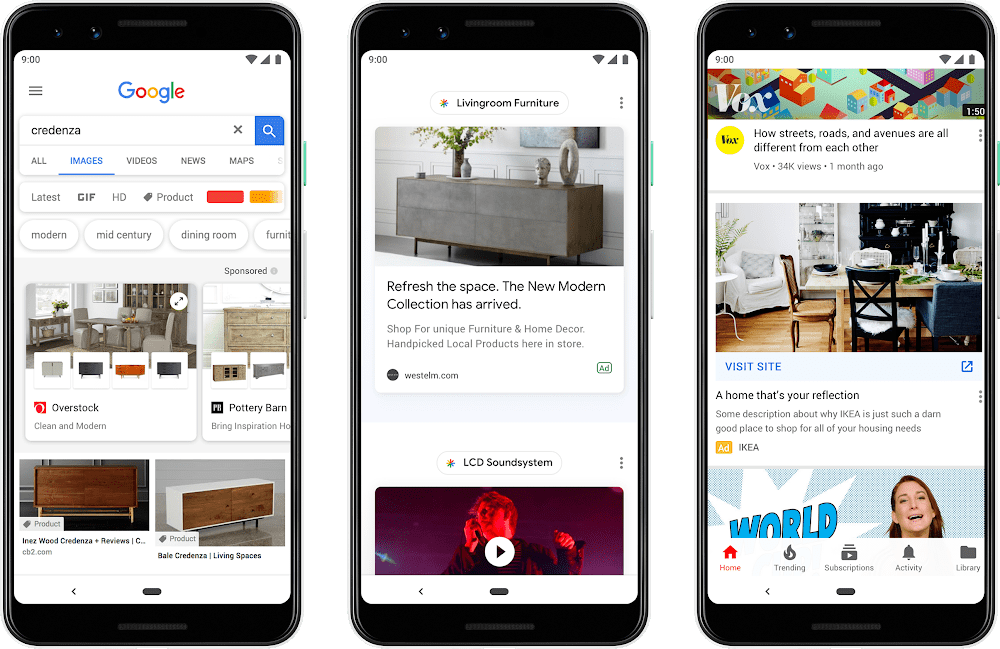

13. Four times as many people are likely to click on a paid search ad on Google (63%) than on any other search engine — Amazon (15%), YouTube (9%), and Bing (6%). (source: Clutch)

14. Videos appear in 6.3% of results, but YouTube drew only 1.8% of all search clicks. (source: Moz)

15. 55% of people clicking on Google search ads prefer those to be text ads. (source: Clutch)

16. For every $1 businesses spend on Google Ads, they make an average of $2 in revenue. (source: Google)

17. The average click-through rate in Google Ads across industries is 3.17% in the search network and 0.46% on the display network. (source: WordStream)

18. 66% of distinct Google search queries resulted in one or more clicks. 34% of searches result in no clicks. (source: Moz)

19. The average cost-per-click in AdWords across all industries is $48.96 for search and $75.51 for display. (source: WordStream)

20. 53% of users will abandon a page if it takes more than three seconds to load. (source: Google)

21. 18% of searches lead the searcher to change their query without clicking any results. (source: Moz)

22. The average Google search session is just under one minute. (source: Moz)

23. The average conversion rate in AdWords across all industries is 3.75% for search and 1.77% for display. (source: WordStream)

24. Image blogs appear in 11% of Google results and earn 3% of all Google search clicks. (source: Moz)

25. When Google opened its proverbial doors in September 1998, they only averaged about 10,000 daily search queries. (source: “The Search”)

How To Find Trending Searches

- Google Trends

- Think with Google

- BuzzSumo

- Feedly

- Ahrefs

- Quora

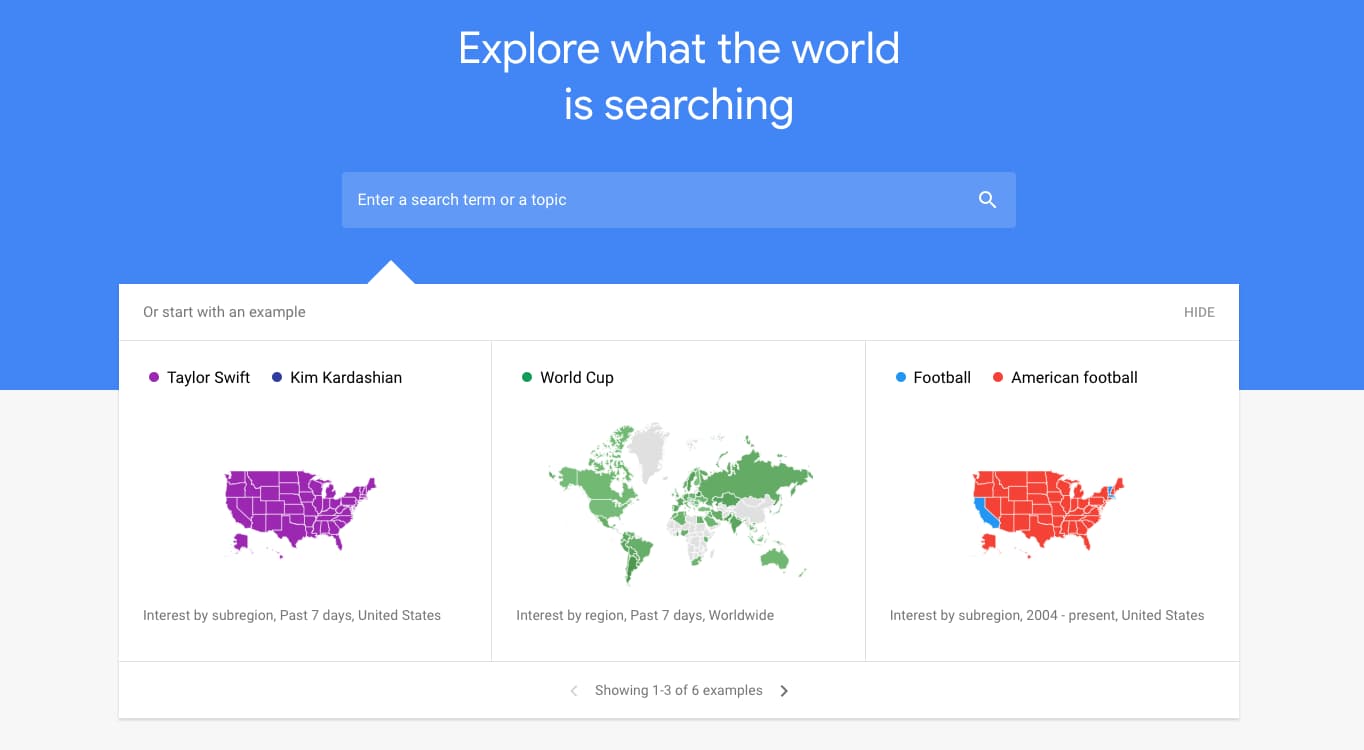

1. Google Trends

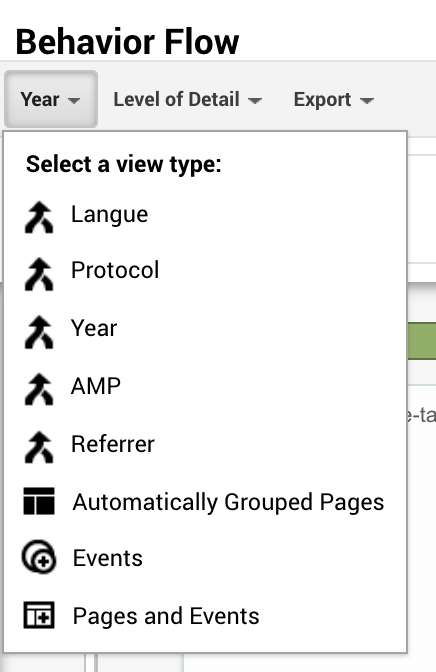

Review the year in search, take Google Trends lessons, and see what’s trending now. You can also view the peaks and valleys of topic interest over time, which uncovers seasonality and allows you to plan your marketing calendar accordingly. Plus, find related topics and queries, and identify sub regions your topic has been trending in to better target your campaigns.

Source: Google Trends

Source: Google Trends

2. Think with Google

Discover articles, benchmark reports, and consumer insights that keep you up to speed on search. From ad bidding strategy to brand jingles, you’ll find interesting content that helps you think bigger while staying educated on how to leverage Google search for your business.

Source: Think with Google

Source: Think with Google

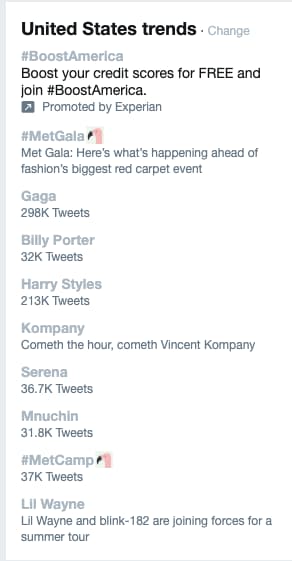

3. Twitter

Sign on to Twitter for more than vaguely hostile political debates. Use the “trends” feature to uncover what’s trending in your state, country, or around the globe. When you click into a trend, you’ll see top tweets about the topic, relevant news stories, and live responses as well.

Source: Twitter

Source: Twitter

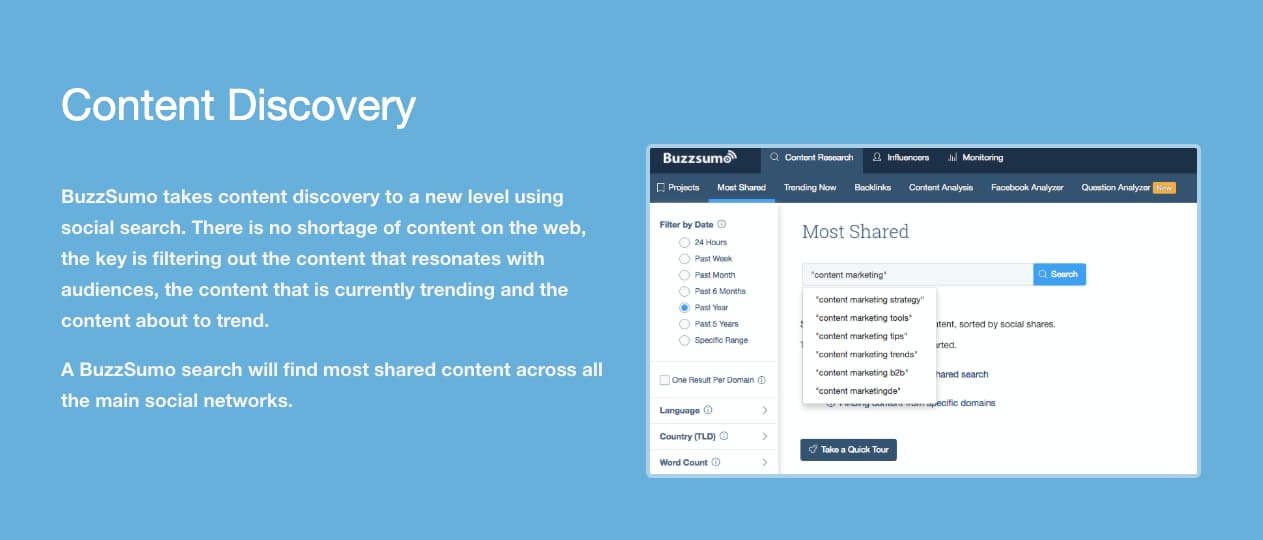

4. BuzzSumo

Identify the most shared content in the previous 12 months or the last 24 hours. BuzzSumo allows you to drill down and analyze the topics that matter to your industry, your competitors, and the influencers you learn from.

Source: BuzzSumo

Source: BuzzSumo

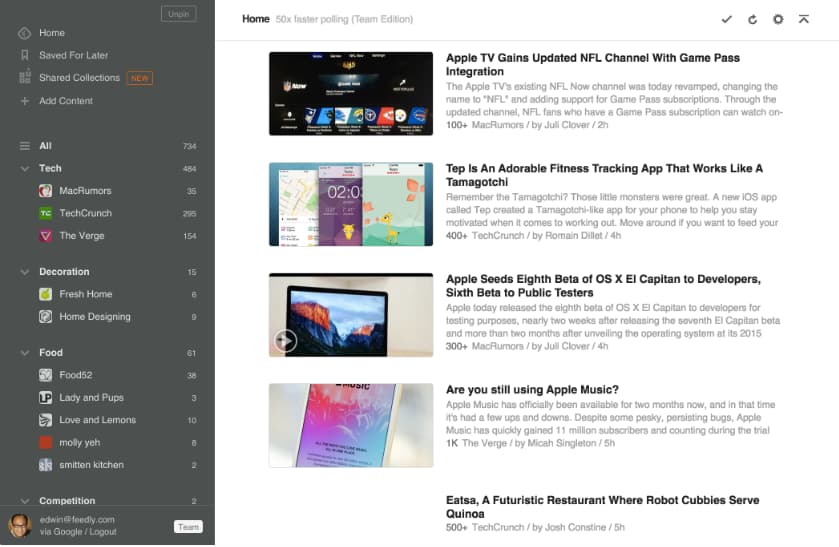

5. Feedly

This RSS feed aggregator allows you to follow your favorite brands and see their most recent content in once place. Add your favorites and discover new publishers by searching your industry, skills, or — you guessed it — trending topics. Feedly also allows you to set up keyword alerts, so you’re always tracking the latest trends on topics you’re interested in.

Source: Feedly

Source: Feedly

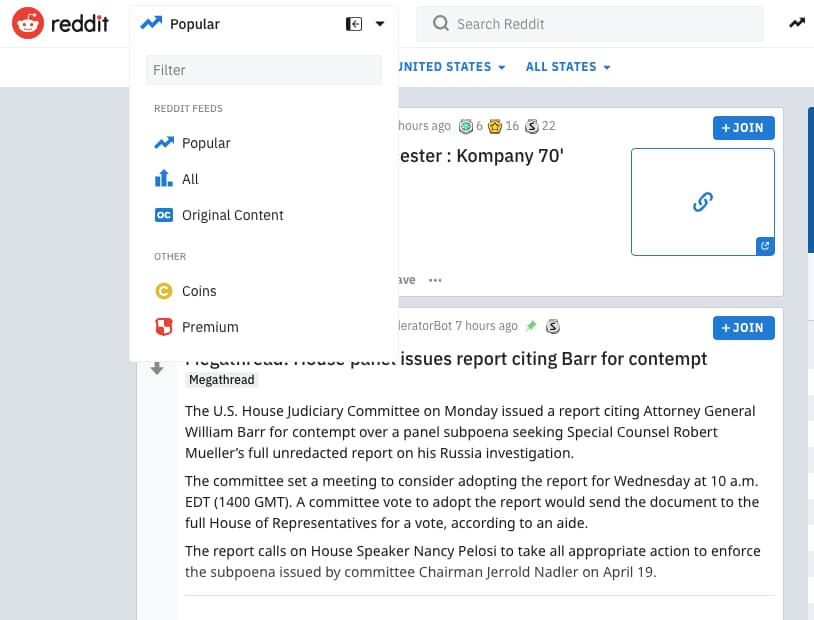

6. Reddit

Freshness and user-based voting determines how content is prioritized on Reddit. A quick visit to the homepage shows you trending or popular posts. And you can filter by country or recency for a more relevant feed.

Source: Reddit

Source: Reddit

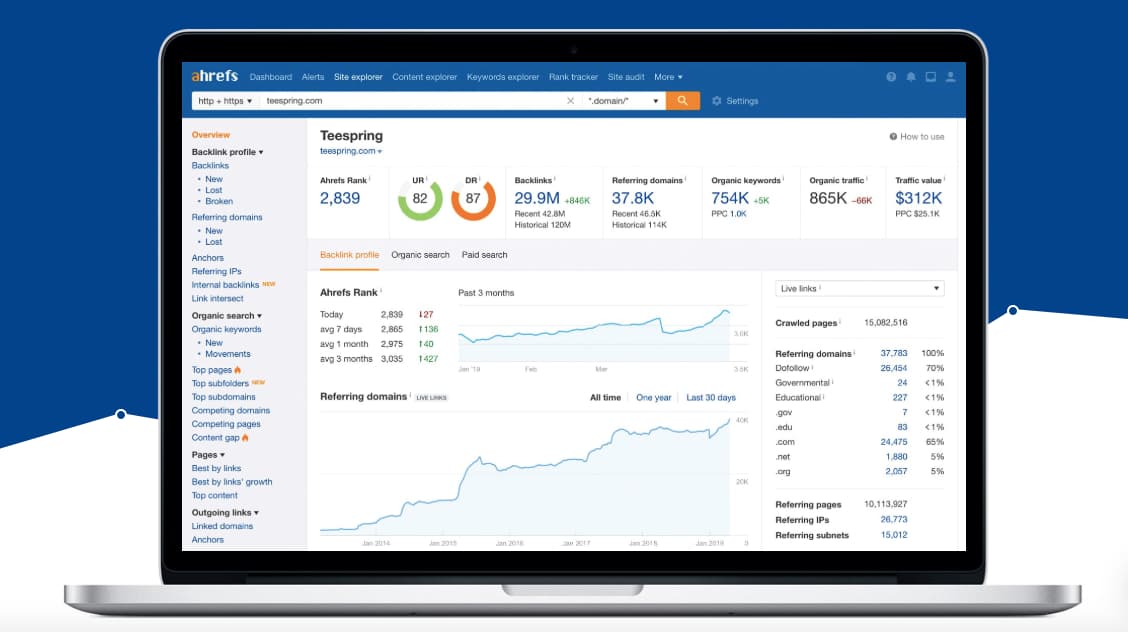

7. Ahrefs

Conduct competitive research, home in on a keyword, or search for trending topics. Ahrefs helps you identify trending content and shows you what to do to outrank your competitors.

Source: Ahrefs

Source: Ahrefs

8. Pocket

Pocket allows you to save content from anywhere on the web. Review your content whenever you wish and head to the Explore page to find trending topics that are relevant to you.

Source: Pocket

Source: Pocket

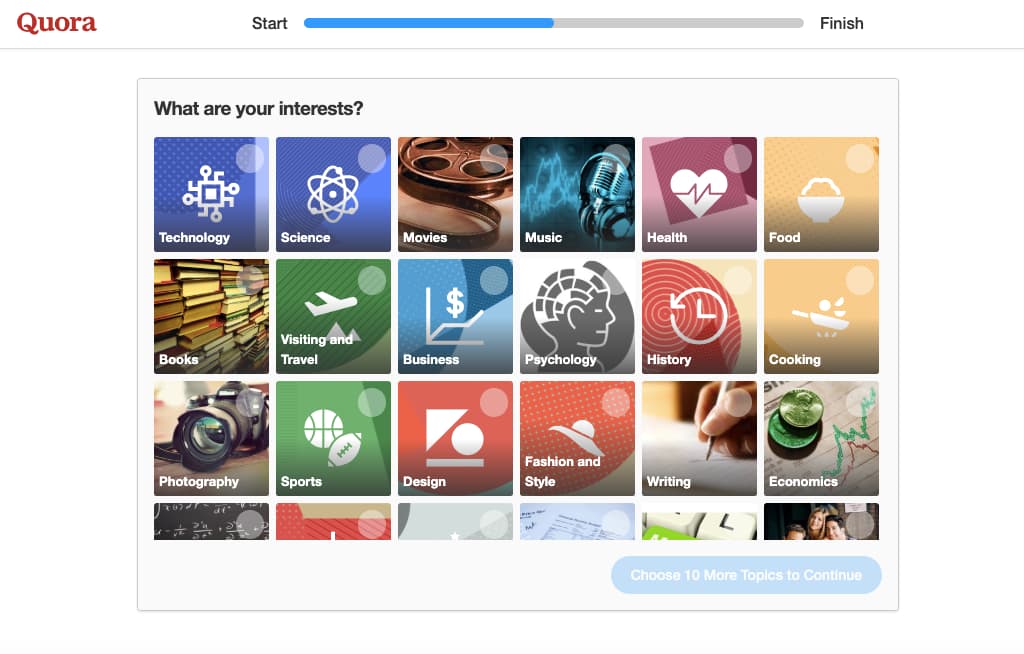

9. Quora

Sign up for Quora and select topic areas that interest you (e.g., “startups,” “marketing,” and “economics”). Quora will stock your feed with questions relating to your content interests. This gives you insight into what your customers are asking, real-time debates about competitors, and even allows you to answer questions about topics you have experience in.

Source: Quora

Source: Quora

Want to dig a little deeper into search? Check out this article by HubSpot’s Dharmesh Shah on how to search on Google.