As brands and consumers seek a return to the physical retail space post Covid-19, the technology that has enabled ecommerce to fill the gap as stores were closed will play a vital role in the recovery of that same bricks-and-mortar retail. Shoppers, particularly in the UK, want a “connected shopping” experience.

The pandemic has obviously hit the UK high street, but shoppers are ready to return, particularly if the ease of online shopping is blended with the richness of the in-store experience. Some 40% of UK shoppers use their mobile in-store to look up more information on a product. And there is a huge increase (80%) among Gen X shoppers who say they will use augmented reality (AR) in shopping over the next five years.

These are the headline findings of a new report, ‘Future of Shopping’, based on a global survey of 20,000 shoppers by trends agency Foresight Factory, for Snap Inc. Technology, rather than sounding the death knell for bricks-and-mortar retail, has led to an irreversible shift to omnichannel that genuinely benefits both shoppers and retailers.

As we have seen over the past 18 months, when new technologies are built primarily around human behaviour, rather than imposed because of internal business needs, their impact can be positive. Yes, online shopping has disrupted bricks-and-mortar retail over the past two decades. However, technology has also helped retailers navigate the increasing overlap between online and physical environments, now a part of our lived experience.

The report reveals that consumers worldwide feel their shopping experience has been greatly enhanced by camera technology and accompanying digital innovations. It is clear that shoppers are keen to get back into stores, but they also want to keep all the advantages of technology when they return; for example, instant access to stock information or home delivery service.

Britons seem more wedded to online shopping, particularly for clothes, than others. Some 44% plan to do the majority of clothes shopping online, above the global average of 38%. Only 34% of Brits said buying in-store was their favoured method of shopping – compared with 43% globally. But nearly half (49%) of Brits missed the social aspect of shopping and more than half (51%) found the inability to try on products frustrating.

This desire to blend online and in-store highlights how vital the mobile phone has become across the shopper journey and explains why the new consumer habits forged in the pandemic are here to stay. However, consumers have missed the social component of physical shopping, so e-commerce advertisers need to greater humanize their brands online.

The report identified several other key takeaways:

Growth in e-commerce during Covid-19 will be sustained

81% of UK shoppers are expecting to do the same amount or more online shopping in the next 12 months compared to last year, with only 19% indicating they plan to do less.

A post-lockdown return to physical retail

Shoppers returning to store post-lockdown will seek the social and tactile experiences they have missed in the last year, albeit combined with the convenience and safety of shopping online. But bricks and mortar stores must act fast to ensure they do not lag behind shopper expectations.

Technology will drive shoppers into stores

Some 35% of global consumers would visit a store specifically if it had interactive virtual services such as a smart mirror that allowed them to try on clothes or makeup.

Mobile will connect brands and consumers across the shopper journey

One in three global consumers choose the mobile phone as their preferred shopping channel, and 50% of Generation Z and millennials say they never go shopping without using one. These trends will only continue, not least in the area of price comparison.

Virtual testing could accelerate e-commerce further

Some four in 10 consumers globally state that not being able to see, touch, and try out products puts them off online shopping. Retailers will therefore need to invest heavily in try-before-you-buy technology to help encourage purchase and reduce the potential need for returns, by enabling consumers to more tangibly engage with products.

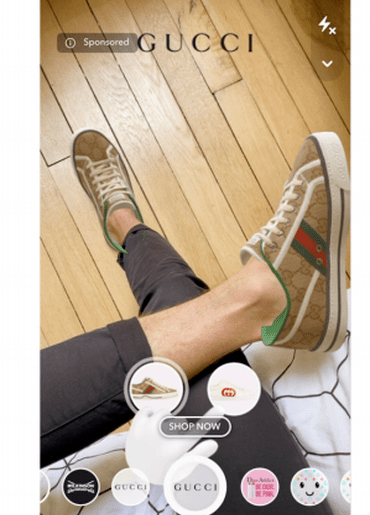

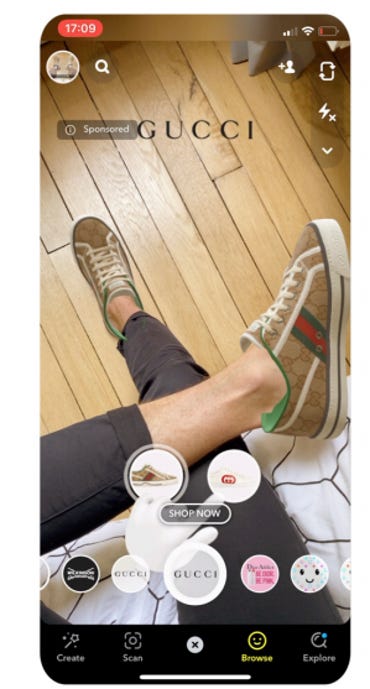

Shoppers will demand widespread AR

Within five years we will see a 57% increase in Gen Z shoppers who use AR before buying. Significantly, 56% of consumers who have used AR when shopping claim it encouraged them to make a purchase. The mobile phone will be the core tool.

New technology could reduce the number of online items that are returned annually by up to 42%. The study estimates that the cost of online returns now amounts to around $7.5 billion each year – and £377m in the UK alone.

Resale platforms cement their position as a credible alternative

Four in 10 consumers globally have bought and sold something via resale platforms, which attract shoppers searching for cheaper prices and unique products. Second-hand goods no longer come with stigma, but are a more desirable, sustainable alternative. Retailers like Levi’s, Ikea and H&M are moving into the branded resale space.

The key trends identified above talk to the blurring of consumer needs and expectations across physical and digital shopping channels. They reflect shoppers’ primary demands (beyond pricing): convenience, social interaction and product testing.

Ed Couchman, general manager, UK, Nordics and DACH, at Snap Inc. says: “People thought the internet and technology was a threat to physical retail but this report clearly shows that those who harness the benefits of tech are best placed to thrive post pandemic. Shoppers want to read reviews, compare prices and try on items using AR – but they also enjoy the experience of going into a shop, speaking to staff, and looking at items. They want the best of both worlds.”

The ‘Future of Shopping: Global Report 2021’ from Snap is available here