By Mike Shields.

- Snap has made easy ad skipping a feature of its Snapchat messaging app.

- That poses a critical challenge for marketers, who are turning to some long-tested tricks to make their campaigns blend in.

- Snapchat has to square its intentions as a chat app with fleeting messages with the demands of advertisers that need a way to see their promotions stick.

NBA star Karl-Anthony Towns was shooting hoops a few weeks ago in a video shared on Snapchat Stories, the social-messaging video feature.

It all looked like a pretty typical Snapchat post — until he casually paused and turned to the camera, with it becoming clear that he was making a pitch for the sports drink Gatorade.

Another video just a few days ago featured a woman — this time not a celebrity — who seemed surprised while looking at someone’s phone, asking “Is this a video?” as the device recorded her reaction. That was an ad for Snickers.

The two ads exemplify a critical element emerging in Snapchat advertising strategies. They are designed to look like other videos on Snapchat; namely, they are less slickly produced and fit the app’s homemade aesthetic, and they blend in to their surroundings (the Towns Gatorade ad was spotted in an NBA-centered Snapchat Story) in a way that might momentarily convince users they were just watching another piece of user-produced video.

Marketers have long tried to make their advertising blend in. So-called native advertising, or promotions designed to resemble a publisher’s normal content, have become a ubiquitous example of that effort. But with Snapchat, the ads reveal a different kind of challenge: Easily skipping video clips or photos, including ads, within a Story is a key Snapchat feature, one that makes it much harder for marketers to stop people in their thumb-tapping tracks as they blaze through content on the app.

For Snapchat’s parent company, Snap, this raises an existential question. Is the platform, founded as a teen-oriented chat program with private, fast-disappearing messages ever going to be hospitable to interruptive advertising?

The best Snapchat ads blend in to Snapchat Stories.Snapchat

In the above cases, it’s likely that Snapchat presold advertisers on ad packages in specific custom stories. For instance, Snapchat knows when it’s planning to run a big Story that will grab eyeballs — such as a roundup of Fourth of July videos (which Google’s Pixel appears to have sponsored on Tuesday) or messages from fans hanging out at Wimbledon. It can sell ad space for these user-generated video compilations to big brands, which can then create custom ads designed to fit in seamlessly with the user-generated content.

But if Snap wants to cater to hundreds of thousands of advertisers, it can’t realistically sell each one ad space in a Story tied to a big event.

Snap recently opened its platform to the masses, as it looks to crank up revenue by attracting advertisers of all sizes after becoming a publicly traded company. It has to be able to accommodate advertisers that have smaller budgets or smaller lead times and those that may not be able to hire an agency to produce eye-catching ads featuring NBA stars.

That means most new Snap advertisers won’t be able to craft the perfect Snapchat-esque ad for the ideally timed Snapchat Story. They’ll have to find another way to get people to stop in their taps.

Does Snap have a unique ad-skipping challenge?

Unlike many other big social and mobile platforms, Snapchat does not make anybody sit through ads. You can always skip through Snapchat’s vertical ads that appear within stories. And nobody forces you to use a brand’s filter to turn your head into a taco (as millions did using a custom Taco Bell ad last year) if you don’t want to.

“What comes to my mind on Snapchat is how many millennials already use ad blockers,” said Rita Mogilanski, a senior strategist at the agency The Marketing Arm. “These consumers are more intolerant.”

Mogilanski said her clients had success running custom special effects and filters on Snapchat. Still, “I think there is a challenge” to keep people from skipping, she said.

Contrast that with Snap’s rivals Facebook and YouTube, where users have a fairly high degree of control over which ads they see but can’t avoid advertising completely. Recently, both are creeping toward introducing more ads, such as Facebook’s burgeoning “midroll” video ads, which people can’t skip. Similarly, YouTube is increasingly running ads that don’t include a skip option.

Google’s Snapchat ads focused on a close up of a Snapchat-like image of a person before pushing the Pixel phoneSnapchat

Google’s Snapchat ads focused on a close up of a Snapchat-like image of a person before pushing the Pixel phoneSnapchat

One ad buyer said Snapchat’s completion rate was lower than its competitors’. But others say it’s no different from the rest of the digital marketing world, where engagement is generally fleeting and expecting people to patiently sit through a 30-second TV ad waiting for their favorite show to air is quickly becoming a thing of the past.

“It’s simply an outgrowth of their platform, in that you are a thumb click away from something else,” said David Cohen, the North America president at the ad agency Magna Global. “The idea of ad skipping is a reality. Period. Full stop. With Facebook’s News Feed it’s the same thing. Or on YouTube, how often do you hit the skip button right way?”

Some brands like Snickers are experimenting with ads that appear to be just like any old Snapchat video.Snapchat

As a marketer, “you have to make your point earlier,” Cohen said.

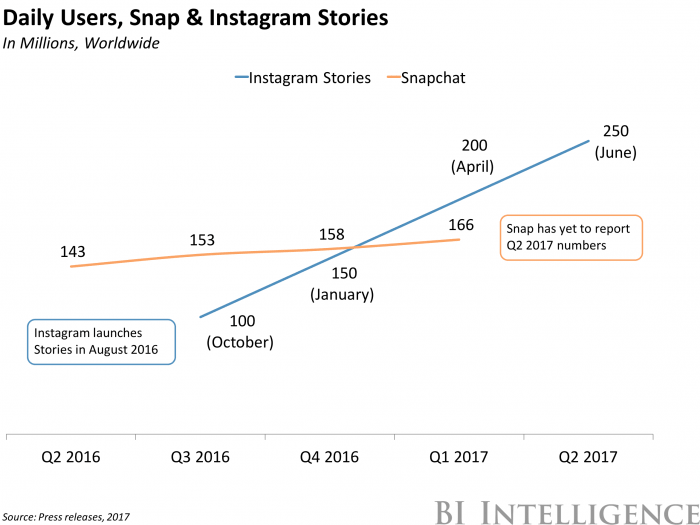

Indeed, Mogilanski noted, as the Facebook-owned Instagram co-opts Snapchat’s Stories format, its ads will face the same high threshold for attention.

What can a marketer do?

Snapchat has been training new advertisers on how to make ads that fit its platform. And the company has recently been nudging agencies to use images and styles that make ads that look like messages from regular people.

Snapchat also has a slew of partner companies that brands can turn to for help. For example, the startup VidMob promises to help marketers produce custom Snapchat ads in just days.

The company operates as sort of a TaskRabbit for web video ads —advertisers can tap into a network of 5,000 freelance producers and editors — and can churn out ads for a few hundred or a few thousand dollars, depending on customers’ needs.

VidMob’s founder and CEO, Alex Collmer, says the challenge Snapchat poses can spark inspiration.

“We haven’t really seen a formula yet, other than cool, interesting, creative,” he said, noting a recent campaign for Colgate, which VidMob made in 24 hours, that urged Snapchat users to turn their phones upside down to see the ads.

“Things need to be much faster paced,” Collmer said. “The cuts are faster. The info comes right away.”

Snapchat is now trying to get all sorts of small and midsize advertisers on board.Snapchat

Lingering doubts

As some ad buyers noted, Snapchat is still very early in its ad-product development.

Facebook, Twitter, and YouTube didn’t have ads early on, and marketers took a while to find their way on those platforms. Facebook didn’t introduce its News Feed until two years into its history, for example, and it rolled out video ads only a few years ago. YouTube resisted preroll ads until a couple of years after Google acquired it.

That doesn’t mean Snapchat doesn’t have serious hurdles to overcome, given its inherent navigation/usage patterns.

Matt Britton, the CEO at Crowdtap, an agency that specializes in marketing to younger consumers, argues that Snapchat has a “core challenge.” Namely, that it is a fundamentally a communications tool for teens and 20-somethings and that content from publishers and brands is an awkward fit.

“It’s a place you go to talk with your best friend about what happened last night,” he said.

He also cites recent moves by web influencers and celebrities to Instagram from Snapchat as evidence that the Snapchat Story format has peaked.

Overall, he offers a fairly brutal assessment, saying that Snapchat was “really not a great platform for advertising” and that the market had “tried to make them into something much larger.”

Feature Image: FILE PHOTO – The logo of messaging app Snapchat is seen at a booth at TechFair LA, a technology job fair, in Los AngelesThomson Reuters