By Gideon Spanier

Growth is forecast to rise 6% in 2020 and digital promise fuels confidence in the future…

Get Brexit done — Boris Johnson’s election-winning slogan, proved the power of an effective marketing message and the UK ad industry begins the new decade in optimistic mood. Rapid changes in technology and consumer habits caused huge disruption in the last decade but digital advertising has been a growth engine as the UK, enjoying ten years in a row of rising ad expenditure. Here are some key trends for 2020:

A Boris ad bounce?

Even before last month’s decisive election result, leading agency groups were forecasting ad growth of around 6% in the UK in 2020 — in line with recent years, and ahead of most Western countries.

Advertisers keep ploughing money into search and social media as the UK is a leader in ecommerce and mobile.

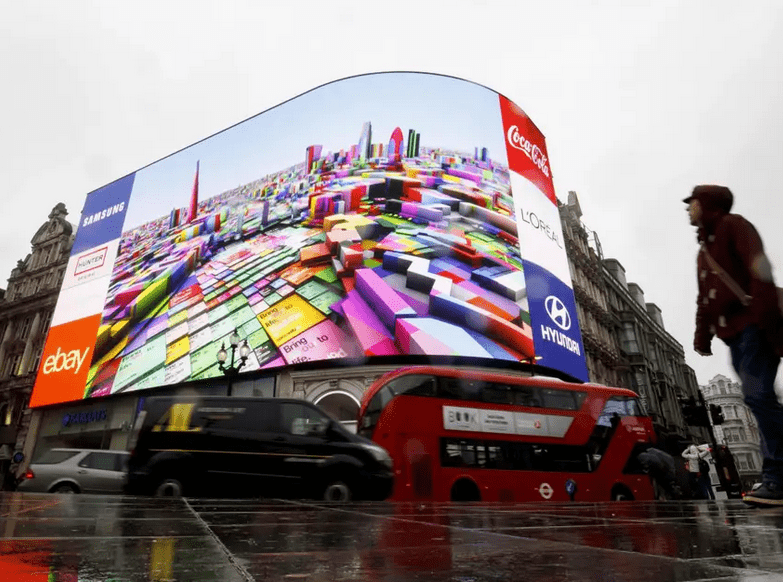

Outdoor billboards are also generating more revenue as poster companies invest in digital screens. Greater “certainty” at Westminster could boost confidence, according to WPP’s media-buying arm, Group M, which sees “some potential for unlocking of advertising budgets — at least in the short-term”.

Brands are still obsessed by digital disruption

Some agency folk say the ad industry should stop talking about “digital” because it is no longer a silo and should permeate everything, but plenty of clients disagree as they grapple with transforming their businesses. Unilever has just appointed Conny Braams as its chief marketing and digital officer — with “digital” added to her job title as the FTSE 100 company behind Dove and Marmite emphasised it wants to become a “future-fit, fully digitised organisation at the leading edge of consumer marketing”.

Similarly, drinks giant Diageo is in the final stages of a global review of its ad-buying account as it seeks to be “at the forefront of media planning and data-driven marketing”.

The rise of streaming and “chasing the missing viewer”

The streaming wars will hot up when Disney+ debuts in the UK on March 31 as a rival to Netflix and Amazon Prime Video. Subscription video on-demand is a worry for advertisers because many of these services carry “no ads”, as the marketing for BritBox, a joint venture between ITV and BBC, boasts.

Zenith, a media agency whose clients include RBS and Disney, has warned “available audiences” for advertisers are shrinking as consumers “replace television viewing with non-commercial video”. One marketer talks about “chasing the missing viewer”, who is now on Netflix, surfing the web or playing video games.

Too much targeting?

Another worry is getting the balance right between mass marketing to big audiences and data-driven targeting of niche groups. Some brands, including Adidas and TopShop, have admitted in recent months that they have focused too much on digital, performance marketing to drive sales, and neglected brand-building. Truth is, advertisers want both. ITV, led by Carolyn McCall, plans to launch a targeted, online video ad-buying service, Planet V, in February.

Holding tech giants to account

Governments and advertisers have struggled for years to hold Google and Facebook to account but the UK’s Competition & Markets Authority could take a lead when it completes a big inquiry in July — with the potential to recommend regulation. The CMA warned last month that “a lack of real competition” in the digital ad market could be harming consumers and other media companies such as news publishers.

Agencies must adapt

Ad spend is rising but some clients are using technology to bypass agencies and “legacy” players are struggling to adapt. Publicis Groupe, Dentsu and M&C Saatchi all warned of poor trading before Christmas. The future for agencies is to be nimbler, more consultative and more strategic, which is creating room for new entrants.

Luke Smith, co-founder of Croud, a Shoreditch-based digital agency that has just sold a £30 million stake to private equity, says bullishly: “There are very few industries globally that have as much energy as the digital marketing space in London.”

London versus the regions

The number of people working in UK creative industries grew 30% in the past decade to two million — with half of them in London and the South East. However, some rebalancing away from the capital towards the regions is likely to be a theme in post-Brexit Britain.

Channel 4 will complete the opening of its new, national headquarters in Leeds this year, Dentsu is to move hundreds of jobs out of London in a cost-cutting move and WPP is planning a “campus” in Manchester to drive expansion.

Advertising matters

All of this change and growth is exciting because new, British disruptors from Starling Bank to On The Beach are using advertising to build their brands and it can add value. Shares in US exercise bike company Peloton, another “new economy” brand, slumped after the poor reception for its “sexist” Christmas ad campaign.

Ultimately, advertising matters because it is how a company communicates what it stands for. And, unlike Brexit, it’s a job that is never done.

Feature Image Credit: Gideon Spanier: Brands are still obsessed by digital disruption when it comes to advertising ( AFP/Getty Images )