By

Food spending is often where that reassessment begins. Groceries are a recurring expense, but can be flexible. While people may feel locked into rising prices, the way food is purchased and used still leaves room for big savings. The most effective changes tend to come from basics that are easy to overlook, and not extreme budgeting tactics or restrictive plans.

Why January creates momentum

The calendar shift matters. January grocery trips are usually calmer than those in late fall, with fewer holiday displays and less pressure to stock up for events. Seasonal routines change as well. School schedules settle, travel slows, and meals become more predictable. This creates space to notice patterns that were hidden during busier months.

Financial awareness is also sharper. Bills from November and December have already arrived, offering a full picture of spending rather than a running estimate. When grocery costs are reviewed alongside utilities, subscriptions, and other fixed expenses, food spending often stands out as one of the few categories that can be adjusted without long-term consequences.

This combination of clarity and calm makes January a practical starting point. The goal is not to overhaul everything, but to tighten habits that will carry through the rest of the year.

1. Planning without rigidity

Planning often gets framed as restrictive, but effective grocery planning is more about direction than control. January is an ideal time to return to simple planning that accounts for real schedules rather than aspirational ones.

This starts with looking at the week ahead. Nights with late work hours or activities may call for leftovers or simple meals. Quieter evenings allow for cooking that stretches ingredients across multiple meals. Planning around time reduces takeout spending, which often spikes when days feel unmanageable.

It also helps to plan around ingredients rather than recipes. Choosing meals that share produce, proteins, or pantry items limits waste and avoids buying one-off ingredients that sit unused. This approach creates a rotation of familiar, easier-to-shop-for meals.

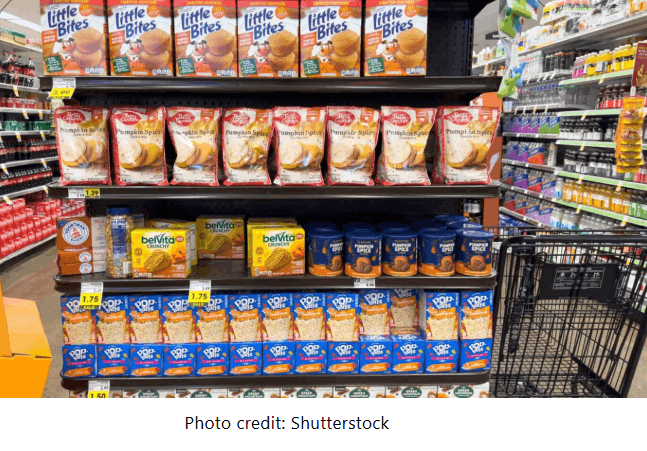

2. Unit price over sticker price

One of the most overlooked tools in grocery stores is printed directly on the shelf. Unit pricing is designed to make comparisons easier. Yet many people still default to the largest package or the lowest visible price tag.

Unit prices reveal patterns that are not always intuitive. Larger packages are not always cheaper per unit. Items on sale can cost more than regular-priced alternatives. Brand loyalty sometimes comes at a premium that is only visible when the math is done.

Learning to pause for a few seconds and compare unit prices changes purchasing behavior without sacrifice. Over time, it builds familiarity with what a fair price looks like for staples. That awareness makes sales easier to judge and prevents overpaying for convenience packaging that offers little real value.

3. The quiet cost of food waste

Food waste is one of the least visible drains on grocery budgets. Items thrown away rarely feel expensive in isolation, but together they represent a steady loss. January cleanouts often reveal expired condiments, forgotten freezer items, and produce that never made it into meals.

Reducing waste starts with awareness, not perfection. Keeping a rough mental inventory of what is already at home prevents duplicate purchases. Using the freezer strategically extends the shelf life of leftovers, bread, and meat that may not be used immediately.

Another overlooked habit is planning meals that intentionally use leftovers rather than treating them as backups. When leftovers are expected and repurposed, they are more likely to be eaten. This alone can reduce weekly spending by meaningful dollars without changing what people eat.

4. Sales cycles and timing

Many grocery stores follow predictable sales cycles, though timing varies slightly by region. Learning those rhythms takes observation more than research. Certain items rotate through discounts every few weeks, while others rarely go on sale.

January sales often reflect post-holiday inventory shifts. Baking supplies and seasonal items may be discounted as stores reset shelves. Recognizing these patterns allows people to stock up strategically rather than reactively.

Timing also applies to shopping frequency. More trips tend to lead to more impulse purchases. Fewer trips help control spending, even if the cart looks fuller. January is a good month to experiment with reducing shopping frequency and seeing how planning fills the gap.

5. Store layouts and impulse pressure

Grocery stores are designed to encourage spending beyond the list. End caps, checkout lanes, and seasonal displays are not accidental.

Sticking to the perimeter is not a rule, but understanding why certain items are placed where they are can help. High-margin products are often positioned at eye level or near traffic bottlenecks. Staples may be placed farther apart to increase exposure to other items along the way.

Being aware of these strategies does not require avoiding entire sections. It simply reframes impulse purchases as deliberate choices rather than defaults. That shift reduces the surprise when totals increase at checkout.

6. Private labels and flexibility

Store brands have expanded significantly in both quality and variety. January is a useful time to reassess assumptions about private labels, especially for pantry staples and basic ingredients.

Trying one or two store-brand items per trip spreads the risk while building familiarity. This creates a personalized list of items where brand loyalty matters and others where it does not. The savings accumulate, especially when applied consistently.

Being open to substitutes when prices spike prevents frustration and keeps budgets steady. This does not mean abandoning preferences; it means recognizing that many products serve the same purpose, with minor differences.

Takeaway

The most effective money-saving habits are often unremarkable. They do not require apps, strict rules, or public accountability. They rely on attention and repetition.

January offers a clean entry point, but the value comes from carrying these habits forward. The savings may not feel dramatic week to week, but they become noticeable over months.

Food budgets rarely improve with a single major change. They improve when overlooked basics are practiced consistently. January is simply the moment when many people are finally positioned to notice them.

Feature image credit: Canva Pro